Your Legacy Advances the Future of Healthcare

Gift planning is a powerful way to make a lasting impact on the world. When you include Cleveland Clinic in your estate plans, you support groundbreaking research, education and innovations for years to come.

Why Plan a Gift to Cleveland Clinic?

Transparency:

100% of your legacy donation supports the cause or program of your choice at Cleveland Clinic.

Flexible ways to give:

You can choose the planned giving option that will help you meet your personal and financial goals. Donate in your will or give through life insurance, retirement assets or a trust.

Benefits:

Your legacy donation provides valuable financial benefits for you, your estate and your heirs. Tax savings on income, your estate, capital gains, gifts and appreciated properties are just a few advantages.

Impact:

Legacy gifts create an impact felt across time and across our enterprise. Your gift supports key priorities and the patients and communities we serve.

Share Your Plans

We encourage our donors and their financial or estate planning advisors to share their donation plans with us now. By informing us of your philanthropic intentions during your lifetime, we can:

- Ensure your gift goes to the cause or program that’s most meaningful for you.

- Enable you to honor a physician or a loved one with your designated gift.

- Recognize your generosity and invite you into our Pyramid Legacy Society.

How to Give

Our experienced Gift Planning team works with you and your advisor to select the donation option that best meets your personal and philanthropic goals. Learn more about the many ways to make a planned gift.

Testamentary gifts

Testamentary gifts are the most common form of planned giving. Choose from:

- Gifts by will or trust: A bequest allows you to leave a gift through a will or trust while still using the assets during your lifetime.

- Beneficiary designations: Designate Cleveland Clinic as the beneficiary of your financial accounts, such as a bank or retirement account.

- Life insurance: Give a gift of life insurance by naming us as a beneficiary on a current or new policy or donating your paid-up policy.

Life income gifts

Life income gifts benefit Cleveland Clinic in the future while providing funds for you and your loved ones today. Options include:

- Charitable remainder trust: Multiple beneficiaries receive guaranteed income for a set number of years. Afterward, remaining funds go to Cleveland Clinic. Learn more about charitable remainder trusts.

- Charitable lead trust: Cleveland Clinic receives contributions for a set number of years. Afterward, remaining funds go to beneficiaries of your choice. Learn more about charitable lead trusts.

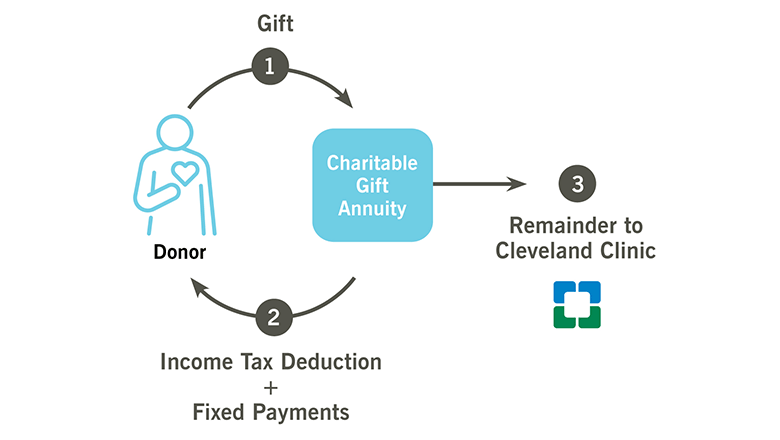

- Gift annuity: We provide a predictable, lifetime stream of income for one or two people of your choosing in exchange for your charitable gift. Learn more about gift annuities.

Outright gifts

Make an outright gift by transferring assets directly. Each of the following assets offers different advantages, such as tax benefits and ease of transfer, and our team is here to help explain the differences.

- Cash or check.

- Stocks, bonds or mutual funds.

- Real estate.

- Tangible personal property (art, jewelry, antiques).

- Life insurance policy.

- Retirement assets.

- Multiyear pledge.

- Grants from foundations, family funds or donor-advised funds.

- Business or partnership interests.

Information for Financial Advisors, Estate Planners and Attorneys

Our Gift Planning team helps financial advisors, estate planners and attorneys choose the right strategy for your clients and our donors. We work together to optimize financial benefits and help individuals achieve their philanthropic goals.

Bequest Language:

“I give and bequeath to The Cleveland Clinic Foundation, Cleveland, Ohio (the sum of $____ or ____%) to support its exempt purposes (or insert name of program or project).”